Contents

Introduction

Bitcoin has started a revolution with the introduction of the very first fully decentralized digital currency, and the one that has proven to be extremely secure and stable from a network and protocol point of view.

As a currency bitcoin is quite unstable and highly volatile, albeit valuable.

Since its introduction in 2008 by Satoshi Nakamoto, Bitcoin has gained massive popularity, and it is currently the most successful digital currency in the world with billions of dollars invested in it.

The name of the Bitcoin inventor Satoshi Nakamoto is believed to be a pseudonym, as the true identity of the Bitcoin inventor is unknown.

It is built on decades of research in the field of cryptography, digital cash, and distributed computing.

Bitcoin

In 2008, Bitcoin was introduced through a paper called, Bitcoin: A Peer-to-Peer Electronic Cash System.

It was written by Satoshi Nakamoto, which is believed to be a pseudonym, as the true identity of the Bitcoin inventor is unknown and subject of much speculation.

The first key idea introduced in the paper was of a purely peer-to-peer electronic cash that does not need an intermediary bank to transfer payments between peers.

Bitcoin is built on decades of cryptographic research such as the research in Merkle trees, hash functions, public key cryptography, and digital signatures.

Moreover, ideas such as BitGold, B-money, hashcash, and cryptographic time stamping provided the foundations for bitcoin invention.

The key issue that has been addressed in Bitcoin is an elegant solution to the Byzantine Generals’ Problem along with a practical solution of the double-spend problem.

The value of bitcoin has increased significantly since 2011, and then since March 2017.

The original idea behind Bitcoin was to develop an e-cash system which requires no trusted third party and users can be anonymous.

If regulations require Know Your Customer (KYC) checks and detailed information about business transactions to facilitate regulatory process then it might be too much information to share and as a result Bitcoin may not be attractive anymore to some.

There are now many initiatives being taken to regulate Bitcoin, cryptocurrencies and related activities such as ICOs.

Securities and Exchange Commission (SEC) has recently announced that digital tokens, coins and relevant activities such as Initial Coin Offerings (ICOs) fall under the category of securities.

This means that any digital currency trading platforms will need to be registered with the SEC and will have all relevant securities laws and regulations applicable to them.

Bitcoin Definition

Bitcoin can be defined in various ways; it’s a protocol, a digital currency, and a platform.

It is a combination of peer-to-peer network, protocols, software that facilitate the creation and usage of the digital currency named bitcoin.

Nodes in this peer-to-peer network talk to each other using the Bitcoin protocol.

Decentralization of currency was made possible for the first time with the invention of bitcoin.

Moreover, the double spending problem was solved in an elegant and ingenious way in bitcoin.

Double spending problem arises when, for example, a user sends coins to two different users at the same time and they are verified independently as valid transactions.

The double spending problem is resolved in Bitcoin by using a distributed ledger (blockchain) where every transaction is recorded permanently and by implementing transaction validation and confirmation mechanism.

Bitcoin – from user’s perspective

Bitcoin is composed of the elements listed here:

- Digital keys

- Addresses

- Transactions

- Blockchain

- Miners

- The Bitcoin network

- Wallets (client software)

Now, we will see how a user will use the Bitcoin network. The following example will help you understand how the Bitcoin network looks from an end user’s perspective.

One of the most common transactions is sending money to someone else, therefore in the following example we will see how a payment can be sent from one user to another on the Bitcoin network.

Sending a Payment

This example will demonstrate how money can be sent using the Bitcoin network from one user to another.

There are several steps that are involved in this process.

As an example, we are using Blockchain wallet for mobile devices.

The steps are described here:

- First, either the payment is requested from a user by sending his Bitcoin address to the sender via email or some other means such as SMS, chat applications or in fact any appropriate communication mechanism. As an example, the Blockchain wallet is shown below where a payment request is created.

- The sender either enters the receiver’s address or scans the QR code that has the Bitcoin address, amount and optional description encoded in it. The wallet application recognizes this QR code and decodes it into something like Please send <Amount> BTC to the Bitcoin address <receiver’s Bitcoin address>.

- This will look like as shown here with values: Please send 0.00033324 BTC to the Bitcoin address 1JzouJCVmMQBmTcd8K4Y5BP36gEFNn1ZJ3.

- In the wallet application of the sender, this transaction is constructed by following some rules and broadcasted to the Bitcoin network. This transaction is digitally signed using the private key of the sender before broadcasting it. From a user’s point of view, once the QR code is decoded the transaction will appear similar to what is shown in the following screenshot:

Note that in the preceding screenshot there are a number of fields such as From, To, BTC, and Fee.

While other fields are self-explanatory, it’s worth noting that Fee is calculated based on the size of the transaction and a fee rate is a value that depends on the volume of the transaction in the network.

This is represented in Satoshis/byte. Fee in the Bitcoin network ensures that your transaction will be included by miners in the block.

- At this stage, the transaction has been constructed, signed and sent out to the Bitcoin network. This transaction will be picked up by miners to be verified and included in the block. The appropriate fee will be deducted from the original value to be transferred and will be paid to the miner who has included it in the block for mining.

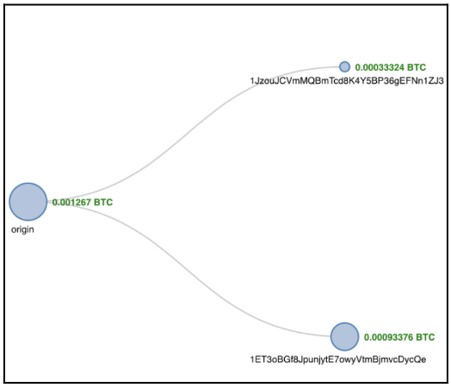

This flow is shown in the following diagram, where a payment of 0.001267 BTC (approximately 11 USD) originated from the sender’s address and was paid to the receiver’s address (starting with 1Jz).

The fee of 0.00010622 (approximately 95 cents) is also deducted from the transaction as a mining fee.

The preceding screenshot visually shows how the transaction flowed on the network from origin (sender) to receivers on the right-hand side.

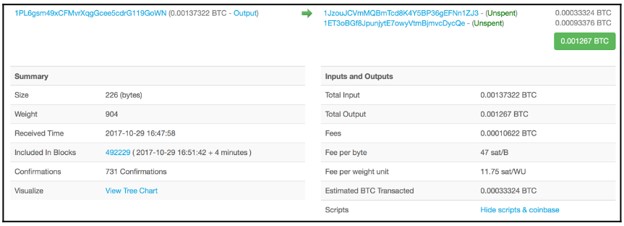

A summary view of various attributes of the transaction is shown below.

Looking at the screenshot below there are a number of fields that contain various values. Important fields are listed here with their purpose and explanation:

- Size: This is the size of the transaction in bytes.

- Weight: This is the new metric given for block and transaction size since the introduction of Segregated Witness (SegWit) version of Bitcoin.

- Received Time: This is the time when the transaction is received.

- Included In Blocks: This shows the block number on the blockchain in which the transaction is included.

- Confirmations: This is the number of confirmations by miners for this transaction.

- Total Input: This is the number of total inputs in the transaction.

- Total Output: This is the number of total outputs in the transaction.

- Fees: This is the total fees charged.

- Fee per byte: This field represents the total fee divided by the number of bytes in a transaction. For example 10 Satoshis per byte.

- Fee per weight unit: For legacy transaction it is calculated using total number of bytes * 4. For SegWit transactions it is calculated by combining SegWit marker, flag, and witness field as one weight unit and each byte of other fields as four weight units.

Bitcoin transactions are serialized for transmission over the network and encoded in hexadecimal format.

As an example, the preceding transaction is also shown here.

We will see later in the Transactions article how this hexadecimal encoded transaction can be decoded and what fields make up a transaction.

01000000017d3876b14a7ac16d8d550abc78345b6571134ff173918a096ef90ff0430e12408b0000006b483045022100de6fd8120d9f142a82d5da9389e271caa3a757b01757c8e4fa7afbf92e74257c02202a78d4fbd52ae9f3a0083760d76f84643cf8ab80f5ef971e3f98ccba2c71758d012102c16942555f5e633645895c9affcb994ea7910097b7734a6c2d25468622f25e12ffffffff022c820000000000001976a914c568ffeb46c6a9362e44a5a49deaa6eab05a619a88acc06c0100000000001976a9149386c8c880488e80a6ce8f186f788f3585f74aee88ac00000000

In summary, the payment transaction in the Bitcoin network can be divided into the following steps:

- Transaction starts with a sender signing the transaction with their private key

- Transaction is serialized so that it can be transmitted over the network

- Transaction is broadcasted to the network

- Miners listening for the transactions picks up the transaction

- Transactions are verified for their validity by the miners.

- Transaction are added to the candidate/proposed block for mining

- Once mined, the result is broadcasted to all nodes on the Bitcoin network

Suryateja Pericherla, at present is a Research Scholar (full-time Ph.D.) in the Dept. of Computer Science & Systems Engineering at Andhra University, Visakhapatnam. Previously worked as an Associate Professor in the Dept. of CSE at Vishnu Institute of Technology, India.

He has 11+ years of teaching experience and is an individual researcher whose research interests are Cloud Computing, Internet of Things, Computer Security, Network Security and Blockchain.

He is a member of professional societies like IEEE, ACM, CSI and ISCA. He published several research papers which are indexed by SCIE, WoS, Scopus, Springer and others.

Leave a Reply